Additionally, a new car warranty will expire in 3-5 years, leaving you with several years of car maintenance repairs as well as your monthly auto loan payment. 72 Month Auto Loanīoth the 84 month auto loan and the 72 month auto loan are considered long-term loans, but the 84 month loan will likely have a higher interest rate.īecause both of these loans are long-term, your car will depreciate and you may end up owing more than the car is worth. However, you should weigh the pros and cons to determine whether an 84-month auto loan is the right choice for you and your family.Ĩ4 Month Auto Loan vs. Advantages and Disadvantages of a 7-Year Car LoanĪ long-term auto loan can make purchasing an expensive car seem more affordable. You can find your amortization schedule for your 84 month auto loan after running your calculation. If you took out a $55,000 new auto loan for an 84 month term at 4.5% interest, your monthly payment would be $764.51.Īlthough your monthly payments won't change during the term of your loan, the amount applied to principal versus interest will vary based on the amortization schedule. Here's how this will look when you enter the data into our 84 month loan calculator: Example of an 84 Month Car Loanįor example, if you plan to borrow $55,000 for a term of 84 months at an annual interest rate of 4.5%, then you will enter: The 84 month auto loan calculator will work the same to calculate the variances.

#Truck finance calculator free#

If you're still considering a variety of auto loan terms or prices, feel free to play around with several of these numbers.

#Truck finance calculator full#

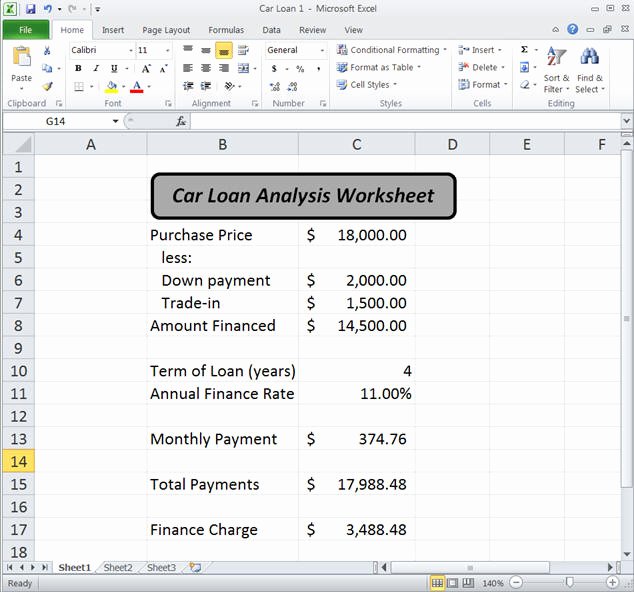

This car loan calculator determines your monthly payment and displays a full repayment schedule based on your: Our priority is our client.How the 84 Month Car Loan Calculator Works Our aim is to get you the best deal for your truck loan.

The more info you provide and the more co-operative you are, the better we can position you in front of our lenders so we create a bidding war for your business. We go into detail during our initial consultation so you understand exactly what we need. In addition, to the above items, we may require additional documents depending on your credit situation.

In order for our team to present your file to one of our lenders, we typically ask for the following items from every potential client For us to give you what you want, we require something in return. Our answer to this requirement has always been the same, as much as we understand trucks and the trucking industry we don’t know you, the driver. We hear this every day from clients who are looking to use us for their truck loan. “Get me the lowest rate, lowest monthly payment with the least amount of money down”

We have worked with many clients and the common requirements from them are: We understand that you have tight schedules and need to get your truck loan approved fast and without any unnecessary obstacles.

#Truck finance calculator drivers#

There is no other way to move goods across cities and countries without the efforts and sacrifices our drivers make every day. At the Truck Loan Center, we understand trucks and the importance of the trucking industry on our economy.

0 kommentar(er)

0 kommentar(er)